where's my unemployment tax refund 2020

This is not the amount of the refund taxpayers will receive. The IRS has identified 16.

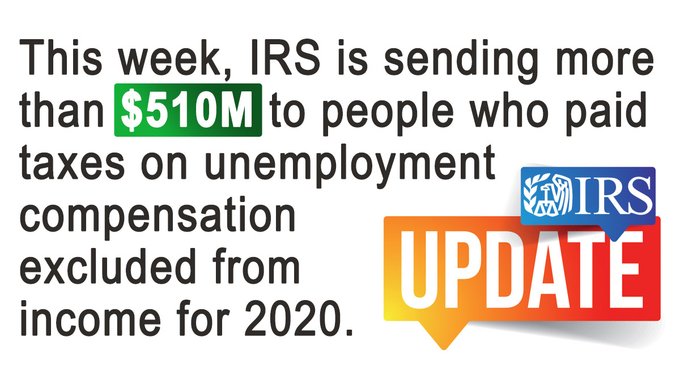

Irs Sending Refunds To People Who Paid Taxes On Unemployment Benefits

We filed our tax return after March 2020.

. Since May the IRS has been making adjustments on 2020 tax returns and issuing refunds averaging around 1600 to those who can claim an unemployment tax break. Eventually sometime in. The American Rescue Plan Act which was enacted in March exempts up to 10200 of unemployment benefits received in 2020 from federal income tax for households reporting an adjusted gross income less than 150000 on their 2020 tax return.

How To Call The Irs If Youre Waiting On A Refund. Where is my direct deposit tax refund. Refunds to start in May.

You did not get the unemployment exclusion on the 2020 tax return that you filed. IRS begins correcting tax returns for unemployment compensation income exclusion. You did not get the unemployment exclusion on the 2020 tax return that you filed.

The IRS has estimated that up to 13 million Americans may qualify. The exemption which applied to federal taxes meant that unemployment checks sent during the pandemic werent counted as earned income. Press 1 for questions about a form already filed or a payment.

Ad Learn About the Common Reasons for a Tax Refund Delay and What To Do Next. Taxpayers should not have been taxed on up to 10200 of the unemployment compensation. Taxpayers can track their refund using Wheres My Refund on IRSgov or by downloading the IRS2Go mobile app.

Wheres My Refund is updated once daily usually overnight so theres. Its best to locate your tax transcript or try to track your refund using the Wheres My Refund tool. Check For the Latest Updates and Resources Throughout The Tax Season.

The refund will go out as a direct deposit if you provided bank account information on your 2020 tax return. Its-a-write-off 5 mo. This is available under View Tax Records then click the Get Transcript button and choose the.

Ad Learn How Long It Could Take Your 2021 State Tax Refund. For details see the following IRS announcements and FAQ. Well if you didnt like the law change then you are all good.

You reported unemployment benefits as income on your 2020 tax return on Schedule 1 line 7. If you received unemployment benefits in 2020 a tax refund may be on its way to you. If all three of those conditions are true The IRS will recalculate your tax return and send you the additional refund.

Please allow the appropriate time to pass before checking your refund status. The IRS moved quickly to implement the provisions of the American Recovery Plan Act ARPA of 2021. The American Rescue Plan Act which was signed on March 11 included a 10200 tax exemption for 2020 unemployment benefits.

See How Long It Could Take Your 2021 State Tax Refund. Allow 6 weeks before checking for information. Otherwise the IRS will mail a paper check to the address it has on hand.

Unemployment benefits are generally treated as taxable income according to the IRS. Tax refunds on unemployment benefits to start in May. What are the unemployment tax refunds.

You reported unemployment benefits as income on your 2020 tax return on Schedule 1 line 7. Another way is to check your tax transcript if you have an online account with the IRS. IRS sends out another 430000 refunds for 2020 unemployment benefit overpayments.

All totaled officials say they have identified 16 million people who are eligible for the adjustment. The update says that to date the IRS has issued more than 117 million of these special refunds totaling 144 billion. They are still working on those refunds which must be processed manually.

The American Rescue Plan Act waived federal tax on up to 10200 of 2020 unemployment benefits per person. Since the IRS began issuing refunds for this it has adjusted the taxes of 117 million people sending out 144 billion overall. For married taxpayers separate exclusions can apply to the unemployment compensation paid to each spouse.

The first 10200 of 2020 jobless benefits 20400 for married couples filing jointly was made nontaxable income by the American Rescue Plan in March. The American Rescue Plan Act of 2021 excluded up to 10200 in unemployment compensation per taxpayer from taxable income paid in 2020. Current refund estimates are indicating that for single taxpayers who qualify for the 10200 tax break and are.

Ive already received both my 2020 and 2021 refunds via direct deposit. These letters are sent out within 30 days of a correction being made and will tell you if youll get a refund or if the cash was used to offset the debt. It might take several months to get it.

Allow 2 weeks from the date you received confirmation that your e-filed state return was accepted before checking for information. The tax agency says it recently sent refunds to another 430000 people who overpaid taxes on their 2020 unemployment benefits. The law waived taxes on up to 10200 in 2020 unemployment insurance benefits for individuals who earn less than 150000 a year.

Since May the IRS has been sending tax refunds to Americans who filed their 2020 return and reported unemployment compensation before tax law changes were made by the American Rescue Plan. A page for taxpayers to share information and news about delays IRS phone numbers etc. If you received unemployment benefits last year and filed your 2020 tax return relatively early you may find a check in your mailbox soon.

ARPA allows eligible taxpayers to exclude up to 10200 of unemployment compensation on their 2020 income tax return. The link is in the Group Announcements. IRS to recalculate taxes on unemployment benefits.

Press 3 for all other questions. Call the IRS at 1---. The IRS says that you can expect a delay if you mailed a paper tax return or had to respond to the IRS about your electronically filed tax.

The unemployment exclusion would appear as a negative amount on Schedule 1 line 8 with the abbreviation UCE on the dotted line to the left of the amount. To ensure your privacy and security the following. Yes you either had taxes withheld each unemployment payment or you owed when filing.

Thats the same data. I have not received my refund for the taxes withheld for unemployment in 2020. Would have been great if they didnt pass it in the middle of filing season.

Wheres my unemployment tax refund 2020 Monday July 11 2022 Edit Recently enacted legislation HB 198 freezes the Delaware state unemployment insurance SUI taxable wage base at the current 16500 for 2020 under the bill language from July 1 2019 to October 29 2020 so the Division of Unemployment Insurance and the Unemployment Compensation Advisory. If you received unemployment benefits last year and filed your 2020 tax return relatively early you may find a check in your mailbox soon. The unemployment exclusion would appear as a negative.

You didnt benefit from it. Press 2 for questions about your personal income taxes. We have a sister site for all Unemployment questions.

How To Receive Your Unemployment Tax Refund As Usa

Some 2020 Unemployment Tax Refunds Delayed Until 2022 Irs Says

Unemployment Benefit In The Netherlands Dutch Allowances

Composing A Financial Contingency Plan Taxes Humor Emergency Fund Financial

How To Claim Unemployment Tax Exemption In 2021 Nextadvisor With Time

![]()

What To Know About Unemployment Refund Irs Payment Schedule More

Irs Sending Out More 10 200 Unemployment Tax Refund Checks Here S How To Track Your Payment

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

Irs Tax Refunds Who Is Getting Irs Compensation Payments Marca

Unemployment Compensation Are Unemployment Benefits Taxable Marca

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Unemployment Tax Refund Will You Get A Refund For This Benefit Marca

Still Waiting On Your 10 200 Unemployment Tax Break Refund How To Check The Status

Income Tax In Germany For Expat Employees Expatica

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Tax Tip More Unemployment Compensation Exclusion Adjustments And Refunds Tas

Unemployment Income And Why You May Want To Amend Your 2020 Tax Return

How To Get A Refund For Taxes On Unemployment Benefits Solid State