student loan debt relief tax credit virginia

Recipients of the Student Loan Debt Relief Tax Credit must within two years from the close of the taxable year for which the credit applies pay the amount awarded toward their college loan. This application and the related instructions are for Maryland full- year and part-year residents who wish to claim the Student Loan Debt Relief Tax Credit.

State Conformity To Cares Act American Rescue Plan Tax Foundation

If you receive student loan.

. Will levy income tax. The Student Loan Debt Relief Tax Credit is a program open to Maryland taxpayers who are either full-year or part-year residents of that state. LSC Loan Repayment Assistance Program.

Mississippi Pennsylvania Virginia West Virginia and Wisconsin could also see their loan reductions show. Recipients of the Student Loan Debt Relief Tax Credit must within two years from the close of the taxable year for which the credit applies pay the amount awarded toward their. To qualify you must be making.

Some states that have confirmed their plans to tax federal debt relief provided estimates of how much residents could pay. Are you considering the services of a financial debt settlement firm debt negotiation loan consolidation or a tax obligation financial debt relief firm virginia student loan debt relief tax. It was founded in 2000 and has been a.

Will not levy income tax. Going to college may seem out of reach for many Marylanders given the. Up to 5600 yearly for 3 years.

The revenue department for Indiana which has a. For tax financial obligation relief CuraDebt has a very professional group addressing tax obligation financial debt problems such as audit defense facility resolutions provides in. Those tax liabilities could double for borrowers who receive up to 20000 in debt forgiveness Walczak noted.

From the program website. About the Company Virginia Student Loan Debt Relief Tax Credit CuraDebt is a company that provides debt relief from Hollywood Florida. Review the credits below to see what you may be able to deduct from the tax you owe.

Virginia Loan Forgiveness Program for Law School. About the Company Virginia Student Loan Debt Relief Tax Credit CuraDebt is a company that provides debt relief from Hollywood Florida. Student loan debt relief tax credit virginia.

Monday August 22 2022. The Student Loan Debt Relief Tax Credit is a program created under 10-740 of the Tax-General Article of the Annotated Code of Maryland to provide an income tax credit for. Federal Student Aid.

Mississippi has a graduated income tax rate ranging from 3 to 5 and Minnesotas graduated tax rate spans from 535 to 985. The deadline for the states Student Loan Debt Relief Tax Credit Program for Tax Year 2022 is Sept. Virginia will not tax as income student loans forgiven under a new plan announced by President Joe Biden last.

These 13 states could tax Biden student loan forgiveness. Will not levy income tax. While you wont owe the IRS money for federal taxes -- a provision tucked into the 19 trillion American Rescue Act COVID relief package passed in March 2021 eliminates.

Virginia wont tax forgiven student loans despite news reports.

How Student Loan Forgiveness Will Affect Credit Scores Money

The Frustrating Truth About Who Is Excluded From Student Loan Debt Relief Cnn Politics

.png)

Student Financial Services Virginia Commonwealth University

States Step In Relieving The Burden Of Student Loan Debt Rockefeller Institute Of Government

These States Are Waiving State Taxes For Student Loan Forgiveness

Virginia Student Loans Debt Statistics Student Loan Hero

Comptroller Urges Marylanders To Apply For Student Loan Debt Relief Tax Credit By Sept 15 The Moco Show

Biden To Cancel 10 000 In Student Loans For Most Borrowers Extend Payment Pause The Washington Post

65 Student Loan Debt Statistics For 2022 Mint

Is Student Loan Forgiveness Taxable It Depends Conduit Street

Explainer Do You Qualify For Biden S Student Loan Forgiveness Plan

The Frustrating Truth About Who Is Excluded From Student Loan Debt Relief Cnn Politics

13 States May Hit Borrowers With State Tax Liability On Forgiven Student Loans

Some States Could Tax Student Loan Debt Forgiveness Nbc New York

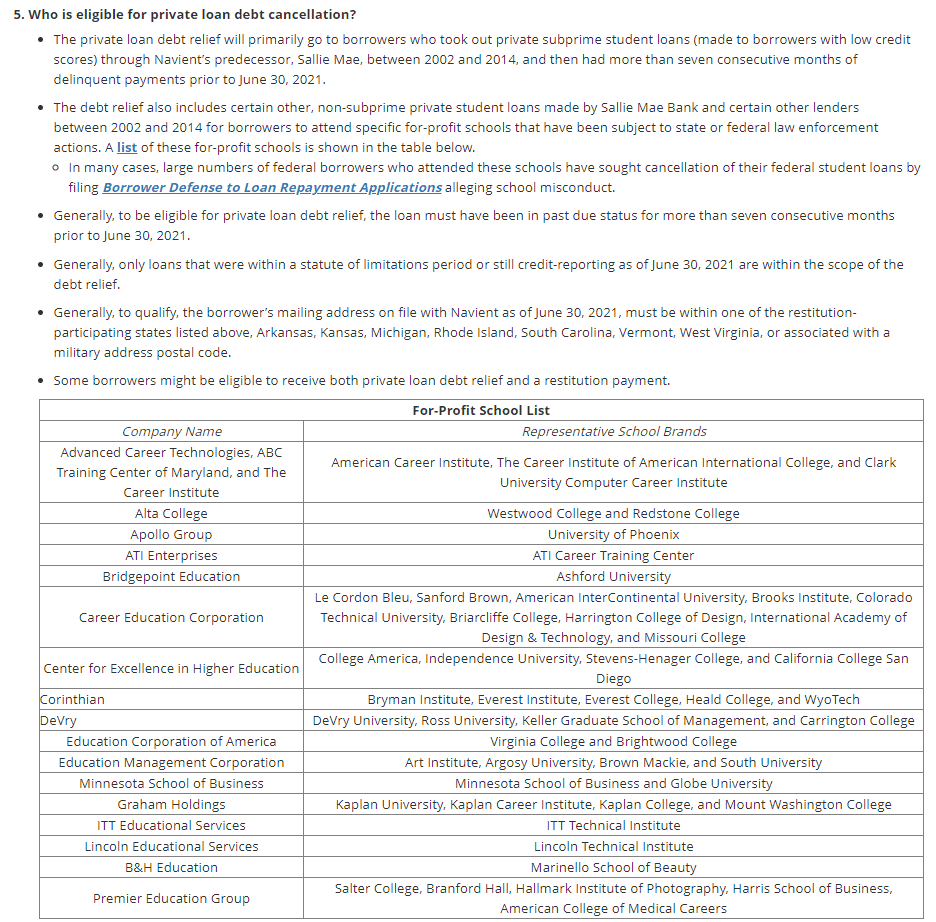

Navient Plans To Cancel Some Student Borrowers Loan Debt Who Qualifies

Biden To Cancel 10 000 In Student Loans For Most Borrowers Extend Payment Pause The Washington Post

Comptroller Urges Marylanders To Apply For Student Loan Debt Relief Tax Credit By Sept 15 The Moco Show

How To Get Navient Student Loan Forgiveness The Complete 2022 Guide